Seafood Case Studies

Seafood Processor Case Study

Improve quality, and get paid for it

Value Creation

Processors use the Certified Quality Reader (CQR) to improve fish quality from fisheries and earn a premium price for higher quality lots.

Future Value Creation

In year one, thresholds for quality measures from individual fisheries will develop. By year two, fishers above the threshold will receive a price bonus, and those below it will not receive compensation. Lower-quality fish suppliers will be given tips on improving their fish quality and may be subject to fewer sales. A Northwest processor used the CQR to measure samples of inbound “Lots” of fish from 5-7 boats. The processor sells high-quality frozen fish for $.10 an lb. premium to the market, and some for an increasingly significant premium for the best lots.

Value Capture

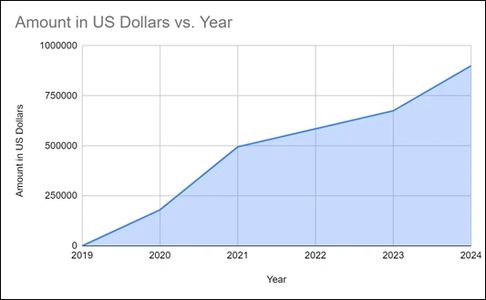

Based on five-year projections, this Northwest seafood producer will make $2,835,000.00 using the CQR to improve quality and identify premium quality lots sold for a higher price (Figure 1).

Summary

One sees higher quality sells for more money in watches, cars, and construction, but it becomes less clear in food products. Most quality measures rely on subjective quality scores. Objectively measuring quality with electricity empowers producers to quantify the quality they offer, thereby increasing profits and quality products.

Controlling quality levels can include not buying low-quality products, improving handling practices from marginal quality producers, and rewarding high-quality producers with bonuses. Rewarding acceptable handling practices and improving bad handling practices from fishers will result in more excellent quality fish going into the freezer resulting in a more significant selling premium price.

The solution to maximizing value from frozen seafood is transparently showing the objective customer measures of quality/degradation of fish before freezing and then educating on freezing locks in that quality. Once frozen, degradation stops or slows dramatically, customers will pay more for better quality fish.

As the fish sells, a quality assurance team measures a representative sub-sample's quality from each batch. Using frozen at sea (FAS), producers sell products at a premium at approximately $.10 per pound. Using the CQR, the team-high grades the top 30% of the fish lots and sells them for an additional $.10 per lb premium. The top 5% of lots were marketing and sold as super-premium fish, selling for as much as $.25lb to $.50lb more to high-end buyers.

Value Capture

Higher Quality Fish

Higher Quality Fish

Figure 1 shows projections of value add using a CQR to improve fish quality from fisheries and selling a higher quality for a higher amount.

Seafood Distribution Case Study

Improve quality and sales, and reduce shrink for a seafood distribution center and its customers.

Value Creation

The distribution company started using our program to improve the quality of inbound fish from suppliers which will result in improved customer satisfaction and trust, reduced shrink, revenue increase. They are using our program to objectively assess inbound quality and monitor outbound quality.

Value Capture

The quality increased in 62% of the inbound species in a six month time period (Figure 1). The increase in quality will improve the reputation and sales in a distribution center while reducing shrink and rejections thus making and saving money.

Summary

Quality problems result in lower customer satisfaction, distrust, lower sales and increased shrink. A distribution center has had inbound quality problems for years.

Contributing factors included suppliers sending substandard quality seafood, and a lack of training and execution of the operations team. Comparing average quality scores of the same species from different DC”s noted that this DC sent lower quality seafood products to customers compared to similarly situated operations. Current QA/QC processes were lax and ineffective and the buyers were unable to significantly improve quality coming from suppliers.

After switching to a digital objective CQR and AMP system “Reports now run in seconds as opposed to the eight to 10 hours that quality assurance personnel previously spent calculating data”

The solution to improving inbound quality is to continually assess inbound products in real time. Buyers can validate CQR indicated quality concerns with traditional organoleptic exams and relay data back to suppliers. Once suppliers know that their product is being assessed by an objective electronic real-time monitoring system, quality will increase.

Figure 1. Trend increases over time by letting suppliers know you are monitoring inbound products with a CQR.

Community Supported Fisheries Case Study

Building trust and confidence using data will expand your sales

Frozen Can Be Better

When it comes to seafood, the question of whether a fish is frozen or fresh matters in more ways than one. Fresh fish is wonderful and healthful, but few consumers realize that carefully handled flash frozen seafood is of equal if not superior quality. Indeed, the perception that “sushi-grade” fish is the freshest quality (and frozen is not) illustrates a paradox that must be overcome. In fact, sushi-grade, as recommended by the FDA, should be previously frozen to kill any parasites. Unfortunately, that term is not regulated and thus can be used with the most questionable seafood products on the market. With the current marketplace flooded with cheap imports of questionable origins, unknown workers and fishing conditions, and environmental impacts, U.S. fishermen need a market differentiator that communicates the values consumers desire the most: quality and freshness.

Frozen seafood, when handled correctly, is of higher quality than most fresh fish and sushi on the market. Fishermen must put more work (and therefore add more value) into flash frozen fish than they do with fresh, and flash freezing locks in the freshness and quality of a fish the day it was caught and processed—whereas many fresh fillets may have been in the grocery seafood display case for eight days or more. Freezing allows small-scale fishermen to participate in and develop markets for underutilized species, thereby increasing resource utilization without increasing fishing intensity. Freezing also allows for buffering against seasonal flooding of core markets. Flash frozen seafood has an opportunity to solve significant issues facing domestic small-scale fishermen such as seasonal swings in volume, distribution cost, and more accurately matched supply and demand, thereby generating much less waste.

Nevertheless, many consumers perceive frozen seafood to be a cheaper, lower-quality product and often expect to pay less. This creates a very real market barrier for small-scale commercial fishermen with lower volume fisheries who need to meet a higher price margin to remain viable.

A final factor is shipping and the associated environmental cost. If fresh product is driven a reasonable distance to market, its relative environmental impact is low. However, most fish consumers live far from where the fish was caught, and the majority of fillets they buy are fresh and shipped by air, which is the world’s most carbon-intensive form of travel. By contrast, when fish is frozen at sea, its taste and quality are practically indistinguishable from fresh and it can also be moved thousands of miles by container ship, rail, or even truck with a much lower carbon footprint.

Value creation

Trust is built on data. Consumers use data to decide whom to buy seafood from. A community supported fisheries (CSF) Sitka Salmon Shares uses our device to build that trust. This gives the consumer confidence that what they are buying is being monitored and is high quality. Here is a video they have on their website.

https://sitkasalmonshares.com/pages/quality-alaskan-seafood

Value Capture

A CSF in Alaska sells a total volume of 200,000 pounds of fish annually. Using quality data to support the trust in seafood sales resulted in 10% (or 20,000 pounds) of their total sales or about $400k dollars annually.

Value Sentence (Tag line/slogans)

Sales will increase with quality data

Data=Trust=Increased Sales

Do you want to know the quality of your fish, your customers do.

Trust is data driven.

Trust is built on data

Trust builds success

Knowledge is trust

Summary

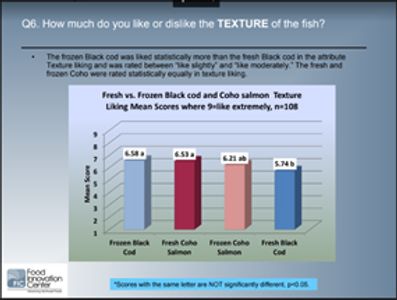

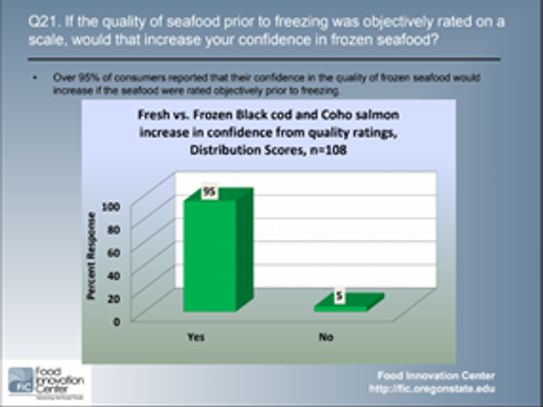

95% of consumers reported that their confidence in the quality of frozen seafood would increase with an objective measure prior to freezing. The solution to selling frozen seafood is 1) showing the customer that you are objectively monitoring the quality of that fish prior to freezing and 2) educating the customer on how freezing locks in that quality. Once frozen, degradation stops. It was revealed that consumers did not prefer fresh over frozen seafood and they would buy more frozen seafood if an objective measure of quality was provided. A study completed with several companies that sell frozen fish, Oregon State University Food Innovation Center and Seafood Analytics showed that consumers did not have a preference of frozen vs. fresh and in some cases, frozen was preferred over fresh. Fresh was never preferred over frozen. Furthermore, the report showed that 95% of consumers reported that their confidence in the quality of frozen seafood would increase with an objective measure prior to freezing.

Consumer Taste Test Report

Fresh and Frozen Black Cod

Fresh and Frozen Black Cod

Figure 1. Title slide from consumer taste test report by Oregon State University Food Innovation Center and Seafood Analytics.

Fresh and Frozen Black Cod

Fresh and Frozen Black Cod

Fresh and Frozen Black Cod

Figure 2. Figure from consumer taste test report by Oregon State University Food Innovation Center and Seafood Analytics. The report showed that frozen black cod was liked statistically more than fresh black cod and no difference between fresh and frozen coho.

Consumer Confidence

Figure 3. Figure from consumer taste test report by Oregon State University Food Innovation Center and Seafood Analytics. The report showed that 95% of consumers reported that their confidence in the quality of frozen seafood would increase with an objective measure prior to freezing.

Certified Quality Foods

info@SeafoodAnalytics.com

Copyright © 2020 CQ Foods, Inc. - All Rights Reserved.

Website Development by www.CreativeVelocity.LLC

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.